does idaho tax pensions and social security

Social Security income is not taxedWages are taxed at normal rates and your marginal state. Part 1 Age Disability and Filing.

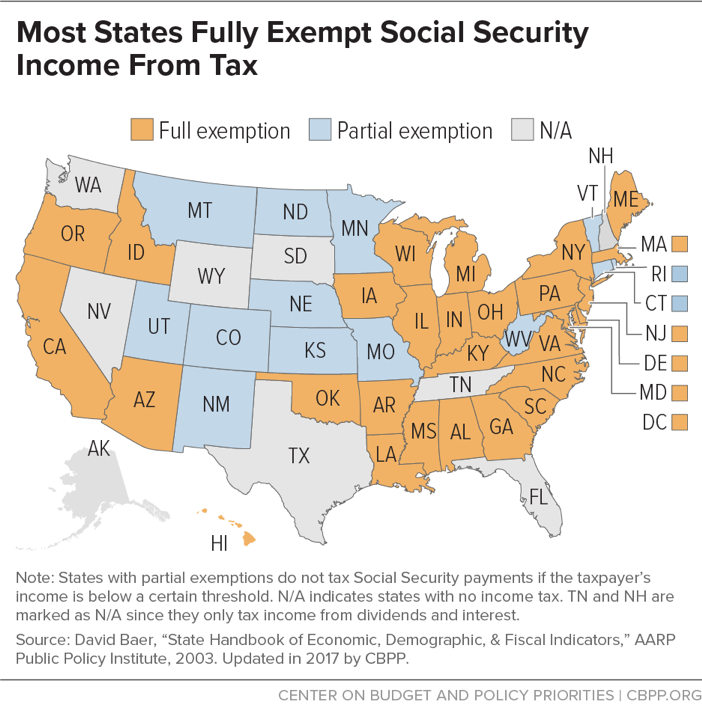

States That Don T Tax Social Security

We have guides to help you learn more about Idaho Residency Status and Idaho Source Income.

. Idaho taxes are no small potatoes. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Additionally the states property and sales taxes are relatively low.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Social Security retirement benefits are not taxed at the state level in Idaho. She became a resident of California and receives pension income from a job she had in Idaho.

The most tax-friendly states for retirees are states that dont tax pensions and Social Security and have a low tax-profile overall for sales and property tax. As is mentioned in the prior section it does not tax Social Security income. Social Security retirement benefits are not taxed at the state level in Idaho.

The state taxes all income except Social Security and Railroad Retirement benefits and its current top tax rate of 6 65 before 2022. Alaska Nevada Washington and Wyoming dont have state income taxes at all and Arizona California Hawaii. Other forms of retirement income such as from a.

Public and private pension. 800-732-8866 or Illinois Tax Department. The state allows a subtraction from benefits ranging from 2645 for married taxpayers who file separately to 4130 for.

Idaho is tax-friendly toward retirees. Nonresidents pay tax only on income from idaho sources. The Base Plan is a qualified tax-deferred plan under IRS Code Section 401 a.

There is a formula that determines how much of your Social Security is. Most pension benefits are currently taxable on your Idaho state income tax return. Now that they are collecting Social Security the tax calculation requires an extra step.

Which states do not tax pensions and Social Security. 52 rows Employer funded pension plans exempt these self-funded plans may be fully or partly taxable. Additionally the states property and sales taxes are relatively low.

Minnesota partially taxes Social Security benefits. Overview of Idaho Retirement Tax Friendliness. How Much Does Idahos Teacher Pension Plan Cost.

Exceptions include Canadian Social Security benefits OAS QPP and CPP and some railroad retirement. PERSI provides retirees with a stable lifetime monthly income to supplement their Social. While potentially taxable on your federal return these.

Does idaho tax pension benefits. Even though the pension income is from an Idaho source federal law prevents. Some of the best.

Idaho is tax-friendly toward retirees. Are retirement pensions taxed in Idaho. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Object Moved This document may be found here. You also dont have to pay taxes on your social security benefits. Colorado allows taxpayers to subtract some of their Social Security income as well as pension income as long as they are age 55 or older under the pension and annuity.

It S Tax Time Do You Qualify For A Reduction In Idaho Property Taxes Idaho Capital Sun

10 Best Places To Retire In Idaho Smartasset

Taxation Of Social Security Benefits Mn House Research

Idaho Estate Tax Everything You Need To Know Smartasset

13 States That Tax Social Security Income The Motley Fool

State Income Tax Rates And Brackets 2022 Tax Foundation

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Az Big Media Here S Where Arizona Ranks Among Best States For Retirement Az Big Media

Social Security Benefits To Jump By 8 7 Next Year East Idaho News

States Should Target Senior Tax Breaks Only To Those Who Need Them Free Up Funds For Investments Center On Budget And Policy Priorities

37 States That Don T Tax Social Security Benefits

State Income Tax Rates And Brackets 2021 Tax Foundation

Do You Have To Pay Tax On Your Social Security Benefits Greenbush Financial Group

24 States That Don T Tax Retirement Income

37 States That Don T Tax Social Security Benefits The Motley Fool

These States Don T Tax Military Retirement Pay

Tax Withholding For Pensions And Social Security Sensible Money